Helping Moms Save for the Future

As a mom who manages the household and keeps an eye on every peso, I’ve learned how important it is to save for big emergencies and small family needs. Whether it’s for tuition, medicine, or even a simple weekend treat, savings give me peace of mind. But let’s be honest, saving isn’t always easy, especially when banks feel intimidating or far from home.

The Problem with Traditional Saving

According to the Bangko Sentral ng Pilipinas, only one in three Filipinos can save money, and even fewer put their savings in a bank. Many still keep cash at home where it’s more vulnerable to theft or fire. It’s a worrying thought, especially when we’ve worked hard to earn that money.

A New Way to Save with GCash and Cebuana Lhuillier Bank

That’s why I was so happy to discover eC-Savings by Cebuana Lhuillier Bank through GSave on the GCash app. It’s a simple, practical way to open a high-interest savings account straight from the app I already use to pay bills and buy a load. No need to visit a branch or submit a bunch of IDs.

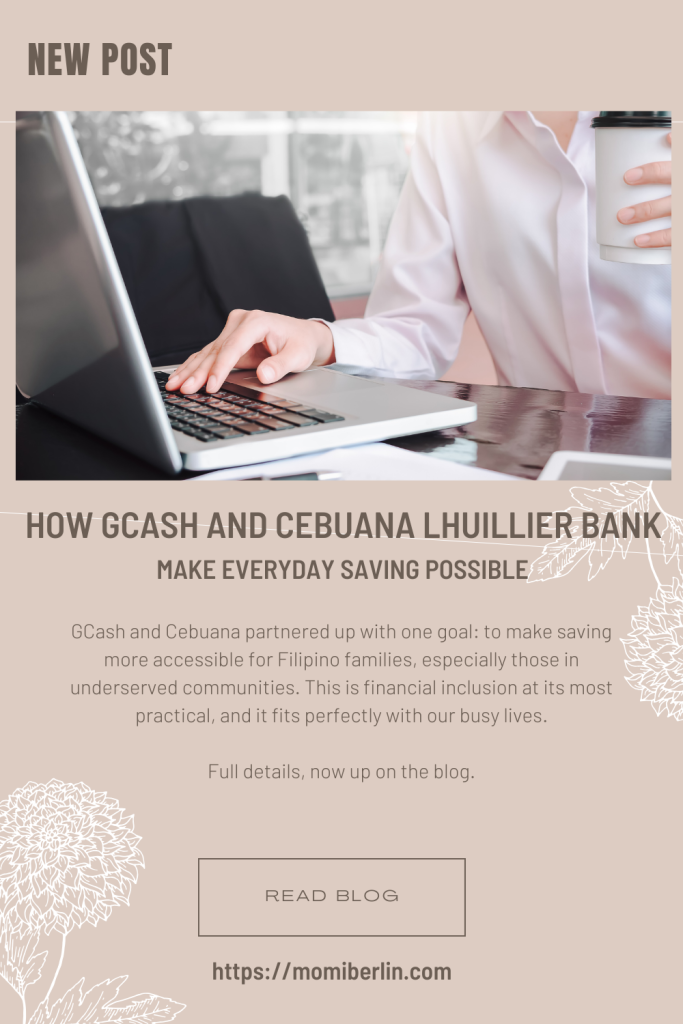

GCash and Cebuana partnered up with one goal: to make saving more accessible for Filipino families, especially those in underserved communities. This is financial inclusion at its most practical, and it fits perfectly with our busy lives.

Easy Access with Real Benefits

Once you open an eC-Savings account through GSave, you’ll enjoy:

- 3.5% interest per year, no matter how big or small your deposit

- No minimum maintaining balance, so your account stays open even if you only deposit small amounts

- Initial cashback of PHP 100 when you open an account

- Up to PHP 33,000 in free accident insurance, which is something I truly appreciate as a mom

These benefits remove the everyday worries that stop many of us from opening savings accounts in the first place. There’s no pressure to deposit large amounts, and no risk of losing the account if you cannot top up for a few months.

No Bank Visits, No Hassle

Another thing I love is how completely online the process is. I didn’t have to go to a physical branch or gather documents. As long as you’re a fully verified GCash user, at least 18 years old, and a Filipino citizen, you can open your eC-Savings account right from the GCash app.

Go to your GCash dashboard, tap GSave, and find eC-Savings by Cebuana Lhuillier Bank under the “Grow” section.

Start Small, Build Steady

What makes this perfect for moms like me is the flexibility. You can start saving with just PHP 1. That’s right—one peso. I can slowly build my savings without feeling guilty or pressured. And it makes me feel good knowing I’m taking one small step closer to securing my family’s future.

Why This Matters for Moms Like Us

We juggle budgets, school fees, groceries, and sometimes even supporting extended family. Knowing that we have a safe and straightforward way to grow our savings, one peso at a time, is empowering. It’s not just about money, it’s about confidence, security, and setting a good example for our kids.

If you haven’t tried GSave yet, download the GCash app from the Apple App Store, Google Play, or Huawei App Gallery and explore the eC-Savings by Cebuana Lhuillier Bank. It’s easy, accessible, and might be the financial step forward you’ve been looking for.

You deserve financial peace of mind. This is one way to start.

0 Comments