I seldom leave the house now as I find it difficult to walk around. I am 34 weeks pregnant and in a few weeks or a month from now, will be giving birth to our fifth boy. An invitation from Good Housekeeping Philippines came and it was too hard to resist. The country’s number one family and home magazine aims to bring a wealth of reliable information on a breadth of subjects that every homemaker cares about – Money Matters.

Do not sell the investment. Sell the behavior.

I attended the two-hour seminar and went home inspired. Though I do not offer insurance or the likes, I learned something an insurance agent must do. Or the behavior each individual must have when faced with the question “Are you interested in having an insurance?”

Do not sell the product. Sell the behavior.

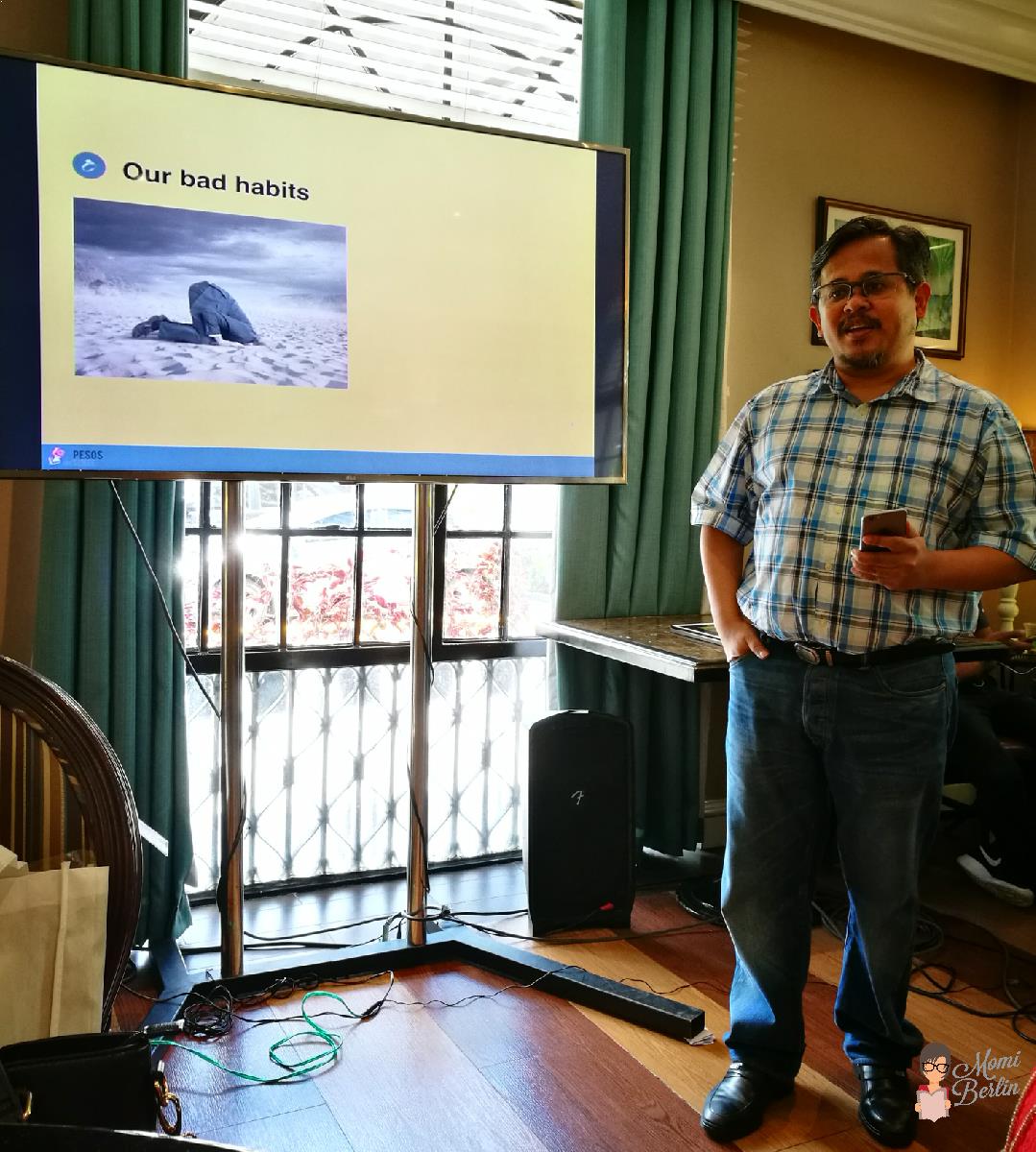

Aya Laraya, an investment advocate and TV host of Pesos and Sense

Perhaps I’ve been offered to buy insurance about a dozen times or more before I finally plunged in. And just like the usual answer of more than a hundred or more individuals asked to consider insurance, I often tell the agent “I still do not have money.”

At the Good Housekeeping Money Matters seminar, Aya Laraya spoke of improving financial literacy. And the best way to accept insurance among other investment, is a change of behavior. We need to change our behavior in order for us to afford the change. That change is our lifestyle. Mr. Laraya, by the way, is the co-founder of Acudeen, the first online marketplace for invoice discounting in the Philippines. Also, he is an investment advocate with 25 years of experience in different financial industries.

Having an investment means sacrificing or changing our way of life. We have something to give up in order to accommodate the new obligation to pay the monthly or annual premium. The return, though, is promising.

There is a guarantee of income or return of investment for retirement. Or we could get dividends which may further grow depending on the behavior of our economy.

Do not sell the investment. Sell the behavior.

Empowering moms to obtain financial freedom

I, for one, am intimidated by other money-related topics, investment and insurance included. It is helpful indeed for moms like me that Good Housekeeping demystifies such issues. It helps me understand more my options and assists me in obtaining financial freedom.

I got life insurance for myself and my boys years ago. Good thing I was also able to invest in Mutual Funds when I was still working. Somehow, I am secured of my boys’ future should something happens to me. Not being sentimental here, but just practical.

How about you, have you already changed your behavior toward investment?

Momi Berlin Directory

Good Housekeeping Facebook | Instagram | Twitter

Wow a great content, this might be attractive performing our analysis about remembering. Thanks a lot

I agree with you.I hope that helps.

I can’t say I’ve changed my behavior when it comes to investment but right now, I am slowly learning about finances and investments. I told you, parang malaking jigsaw puzzle sa’kin ‘tong finances and like many other people, I wasn’t sure how to start. Right now, I find it helpful to watch investment 101 tutorials on YouTube. Yesterday, I watched a few of BPI’s investment info videos and today, I watched a clip from Bo Sanchez. I don’t want to get into something that I’m not too familiar of so this is what I want to do first for now, to educate myself.

I want to invest in the future. I’ve been offered insurance in the past as well and have declined not because I wasn’t interested but because we really don’t have the extra funds to sustain one right now. Our priority in terms of finances is to build our savings first. Then when we have more than enough of that, that’s when investing can take place.

I so love Aya Laraya. He really helped me shift into the correct mindset. Had the privilege to attend his Money 4 Life workshop last year for 6 Saturdays and it was really a huge learning opportunity for me.