PSBank Makes Financial Success Simple for Filipino Families

Hey, moms! We all know how important it is to manage our finances wisely, especially when we’re saving up for our family’s future. That’s why it’s great to know that Philippine Savings Bank (PSBank) just celebrated its 64th anniversary by continuing to help Filipinos achieve their financial goals—whether it’s growing your savings, buying your dream home, or financing that much-needed family car.

A Legacy of Financial Growth

PSBank’s success over the years shows just how dedicated they are to supporting Filipino families. In 2023, the bank reached a record-high net income of Php 4.53 billion, and it’s continuing to thrive in 2024. As the country’s leading thrift bank, PSBank has built a strong reputation for helping people secure home and car loans, making the journey toward financial security easier and more attainable.

Simple and Fast Loan Approvals—Perfect for Busy Moms!

Need a car to make school runs easier or a bigger home for your growing family? PSBank is making it simple to get loan approvals fast. They’ve made sure that applying for a home or auto loan is a breeze, with minimal hassle. In fact, PSBank’s auto loans have been a major driver of their growth, with total gross loans growing by 10% this year. So, if you’re dreaming of a new car or a place to call your own, PSBank has a variety of accredited developers and partners to make that dream a reality.

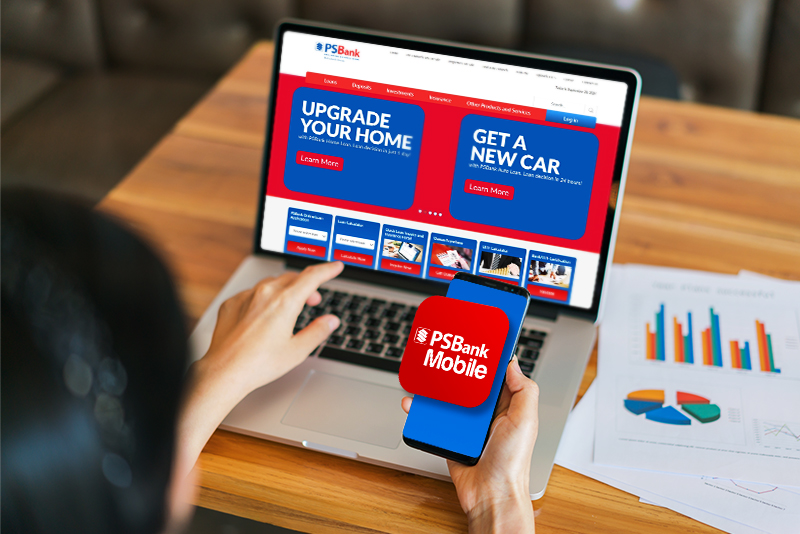

Banking Made Easy with Innovation

As moms, we’re always juggling a million things, so we need tools that make life easier. PSBank gets that! Over the years, they’ve introduced innovative products and services to ensure that banking is as simple as possible for us busy moms.

- PSBank Mobile App: Manage your accounts, transfer money, and even open a savings account with just a selfie and one valid ID—all from the comfort of your home.

- Mobile Time Deposit: Want to grow your savings? You can easily open a time deposit with as little as Php 10,000 using the PSBank Mobile App, and you’ll start earning interest within 30-90 days.

- Photo Check Deposit: No need to go to the bank to deposit checks! Just snap a photo using the app, and your check will be deposited (if you have at least a Php 50,000 average balance).

- Bills Payment with QR: Pay your bills quickly and effortlessly with just a QR code, making errand day that much smoother.

Cutting-Edge Services for Busy Families

PSBank is constantly evolving to meet the needs of Filipino families. Whether it’s the cardless withdrawal service (you can withdraw from an ATM without your card!), or the Queue Anywhere feature (get a queue ticket online so you don’t have to wait long at the branch), PSBank is here to save you time and energy.

They’ve even made it easier to manage your family’s toll expenses with real-time reloading for Autosweep and Easytrip RFIDs using the PSBank Mobile App. No more worrying about topping up before your next family road trip!

Security and Peace of Mind

With everything going digital, it’s important to know that your family’s finances are safe. PSBank takes security seriously, offering features like account access locks and the option to lock or unlock your ATM card, giving you extra control over your money.

Simple Solutions for Everyday Needs

PSBank’s “Ito Simple” campaign is all about showing that there’s an easier way to handle life’s financial challenges. Whether it’s saving for the future, buying a family car, or simply paying the bills, PSBank is here to make those tasks more manageable.

If you’re a mom who wants reliable, easy-to-use banking services that help you meet your family’s goals, PSBank is the partner you can count on. Because at the end of the day, banking doesn’t have to be complicated—it can be simple, just like how we like things in our busy mom life!

Momi Berlin Directory

psbank.com.ph | Facebook | Instagram | TikTok

0 Comments